Best Time and Billing Software Solutions for Accountants: Optimize Your Accounting Efforts

Are you an accountant looking to streamline your time tracking and billing processes? In the fast-paced world of accounting, efficiency is key. That’s why finding the right time and billing software is crucial. It can make a world of difference. It can optimize your workflow and maximize productivity. Let’s dive into the best solutions for accountants. These will enhance their accounting seamlessly.

Why is Time Tracking Essential for Accountants?

Bookkeepers need robust time and billing tracker.It lets them capture online time spent on tasks and projects accurately. By tracking their time, accountants can learn much, which can ultimately reduce the time spent on administrative tasks and improve overall productivity. They can see how they allocate their resources and prioritize their work well. This data improves efficiency. It helps find areas where time can be used better. In the world of accounting, every minute counts.

Time tracking helps accountants bill clients accurately. They bill based on actual hours worked. This leads to more transparency and client satisfaction. It also helps monitor project progress. It ensures that deadlines and budgets are met. Basic time tracking provides a clear record of billable hours for each client or project. It helps bookkeepers justify their fees with detailed documentation. It also helps evaluate performance. It does this by measuring individual productivity in the firm. It uses objective metrics, not subjective ones.

Benefits of Time Tracking for Efficient Accounting

Tracking time is a game-changer for accountants looking to boost efficiency and productivity. With Corcava, they can see how they spend time on tasks.

- Insightful Workflow Analysis: Tracking time provides insights into the workflow of bookkeepers, enabling them to identify areas for improvement and make processes more efficient.

- Accurate Client Billing: Corcava ensures precise time tracking, enabling accountants to bill clients accurately based on the hours worked on specific projects or tasks, fostering trust and fairness in billing practices.

- Profitability Analysis: Time tracking software solutions for accounting firms help analyze profitability by comparing estimated project times with actual hours spent, aiding in informed decision-making.

- Resource Allocation: Time tracking assists in better resource allocation within the firm by identifying where time is utilized, facilitating strategic staffing decisions and maximizing efficiency. These benefits include time analysis for more informed planning and resource management.

They can also set project priorities. Integrating time tracking into accounting practices leads to increased profitability and client satisfaction.

How Time Tracking Improves Billing Accuracy

Time tracking plays a crucial role in ensuring billing accuracy for accountants. By accurately recording time on tasks, bookkeepers can bill clients precisely. The bills will show the actual effort put into the work. Tracking time diligently with a time clock makes it easier to assign billable hours. You can assign them to client projects or tasks.

This detail boosts transparency. It also helps justify charges to clients for the services rendered. Accurate time tracking lets accountants find inefficiencies in their workflow. They can then make needed changes to work better. It helps them prioritize tasks well and use resources efficiently. This leads to better performance and client satisfaction.

Reliable time-tracking software helps with tracking how employee time is spent. It lets accountants streamline billing and reduce errors from manual invoicing by maintaining an accurate time record. This automation reduces the chance of underbilling or overbilling clients. It improves the finances of both parties.

Choosing the Right Time Tracking Software for Your Accounting Firm

When picking top accounting time tracking software for your accounting firm, there are key factors to consider. First and foremost, think about the specific needs of your firm. Do you require a solution that integrates seamlessly with your existing popular accounting software? Consider the user-friendliness of the software. Will your team find it easy to adapt to and use efficiently? They can streamline workflow and boost productivity. They allow for seamless collaboration between team members on many projects. Evaluate the cost-effectiveness of the software. Invest in a quality solution. But, make sure it fits your budget. And do not compromise on essential features for top performance.

Features to Look for in Billing Software for Accountants

When choosing billing software for accounting firms, it’s vital to look for features. They should align with your firm’s needs. Seek out a user-friendly interface that makes tracking and managing time effortless. The software can connect to existing accounting software. This will make workflows smoother and remove manual data entry errors. Look for software that works well with popular platforms. These include QuickBooks time or Xero. Advanced reports can give key insights. They cover billable hours and project profits. Tools for automating time entry can save time. They can also improve efficiency in your firm. Features like automatic reminders for overdue invoices can help maintain healthy cash flow. Prioritize security measures such as data encryption to safeguard sensitive client information. By carefully evaluating these key features, you can pick billing software. It will optimize your accounting. It will also boost productivity in your practice.

Essential Billing Features for Accounting Professionals

When it comes to essential billing features for accounting professionals, accuracy is key. You can track billable hours and expenses in real-time. This makes sure that invoices are precise and reflect the work done. Bookkeepers can tailor their invoicing. They can do this based on different clients or projects. This flexibility enables them to accommodate varying pricing structures with ease.

Integration capabilities with accounting software streamline the billing process by syncing data seamlessly. This integration removes manual entry errors. It saves time, letting accountants focus on more strategic tasks. Detailed reports show revenue streams. They help bookkeepers choose how to run their finances. These reports offer transparency and clarity for both accountants and their clients alike.

Integration Capabilities with Accounting Software

When choosing time and billing features for your accounting firm, you must consider how well it fits your accounting software.

- Seamless Integration: Look for solutions that offer seamless integration, ensuring smooth data flow between systems and eliminating the need for manual entry, thus reducing errors.

- Compatible with Popular Accounting Platforms: Choose software that connects easily with popular accounting platforms such as QuickBooks, Xero, and FreshBooks, allowing for syncing of client information, invoices, and financial data across different tools.

- Streamlined Workflow: Opt for a time tracker that integrates well with your accounting system to streamline your workflow and boost productivity, enabling direct transfer of hours worked to invoicing modules, saving time and ensuring accurate client billing.

- Simplified Processes and Real-Time Financial Metrics: Selecting a solution that integrates well simplifies processes and provides financial metrics in real time, offering a comprehensive view of your firm’s financial performance.

This connection empowers bookkeepers. They can make informed decisions based on current data. It comes from both their time tracking and accounting applications.

Customizable Billing Rate Options for Client Invoicing

When billing clients, customizable rates can make a big difference. You can set different rates for services or clients. This ensures that your invoices show the work done. This flexibility lets you cater to each client’s unique needs. It also lets you work with their budget limits.

You can do this by clearly outlining the costs of each service to clients. This detail builds trust. It also prevents billing misunderstandings. You can adjust them based on things like project complexity or urgency.

Customizing billing rates streamlines your billing and invoicing. It also adds a layer of professionalism to your accounting firm. Clients appreciate clear, detailed invoices. The invoices should reflect the value they get from your services. It lets you make fair invoices. They will build client trust and boost your firm’s revenue.

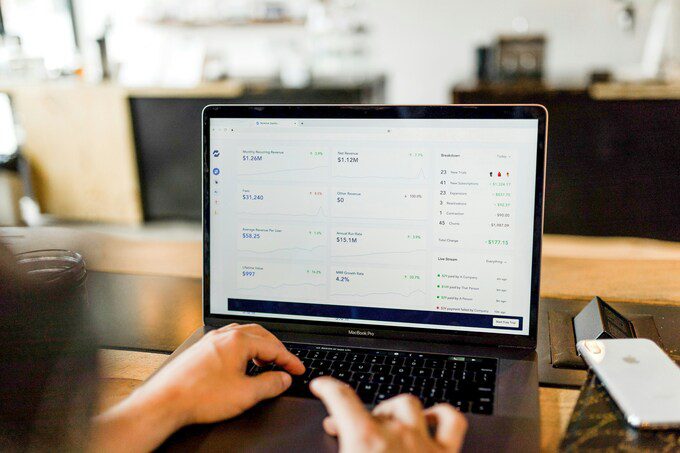

Comparing the Best Time and Billing Software Solutions

When comparing time and billing software for accountants, there are a few key factors to consider. The user interface is one of the most important parts. A clean, easy layout can greatly improve your workflow. Another crucial factor is integration capabilities with existing accounting software. Seamless integration allows for faster data transfer between platforms. It saves you time and cuts errors. This is to tailor invoices to each client’s needs. You can set different rates for each service. This ensures accurate invoicing. Billing software solutions for accounting should integrate with project management to improve your accounting. By evaluating these aspects carefully, you can find the 8 best time and billing solutions. It will match your firm’s unique needs.

Benefits and Drawbacks of Top Time Tracking Tools

Using top time tracking tools can greatly help bookkeepers. The tools provide accurate insights into their daily tasks and improve productivity. The tools offer real-time tracking. They let professionals monitor their billable hours well. The reports have details and time analytics. They help accountants see how they use their time. This helps them make smart choices to improve workflow.

But, some time tracking tools have drawbacks. These may include a steep learning curve for new users. Compatibility issues with existing accounting systems could pose challenges during integration. Accounting firms must carefully evaluate each tool’s features and limits before committing. This is key to ensure smooth adoption and high efficiency in time management.

How to Evaluate Billing Software for Accountants

When evaluating billing software for accountants, you must consider the needs of your firm. Look for features that fit your workflow. They can streamline your billing well. Consider the software’s scalability. Ensure it can grow with your firm.

- Scalability: Ensure the software can accommodate your firm’s growth as you take on more clients and projects.

- Integration: Seek software that easily connects with your existing accounting tools to avoid double data entry and reduce errors.

- User-Friendliness: Opt for software with a clean interface and easy navigation to ensure smooth adoption by all team members, boosting efficiency in time tracking and invoicing.

- Security Features: Prioritize software with robust security features to safeguard sensitive client information and maintain trust.

- Support Options: Evaluate the support options provided by the software company; responsive support can make a significant difference in addressing issues and ensuring smooth operation.

It helps resolve issues quickly. Compare pricing plans to ensure you’re getting value for money.

Key Factors to Consider Before Choosing a Time Tracking Solution

When picking a billing solution for accounting time tracking for your accounting firm, you must evaluate how easy the software is to use. A user-friendly interface can save you time and frustration, allowing you to focus on your core tasks efficiently. Another key factor to consider is the scalability of the software. As your firm grows.

You’ll need a solution that can handle more users and clients. It must do so without hurting performance. Integration capabilities with your existing accounting software are also essential. Seamless integration ensures smooth data flow between systems. It cuts errors and boosts productivity. You can customize these features to fit your firm’s needs. This can greatly affect efficiency and client satisfaction. Don’t forget to prioritize security features when selecting a time tracking solution. Protecting financial data is crucial. It should always be a top priority in today’s digital world.

Optimizing Time Management with Software Solutions

Accountants know time is money. That’s why optimizing time management is crucial for their success.The right software solutions like for accounting firms can help bookkeepers streamline their work and be more productive. Time tracking features help professionals monitor where they spend time. This allows them to make informed decisions on how to allocate resources well. This can help accountants manage tasks and deadlines. This integration enables smooth coordination between team members. It ensures projects are completed on time. Using practice management software makes bookkeepers more efficient. It lets them take on more clients without sacrificing quality. Automating time entry processes removes manual data entry errors.

It also saves time. This time can be used for higher-value activities. It ensures invoices are accurate. It also leads to prompt payment from clients. Choosing time tracking and billing software improves an accountant’s ability. It helps them deliver great service while staying profitable in a tough field.

Time Tracking Integration with Project Management Tools

Linking time monitoring to project progress can boost how accounting firms bill. It can make billing more efficient and accurate. This integration allows real-time tracking of billable hours on tasks in projects. It ensures that clients are accurately billed for the work done. This feature lets accountants allocate resources easily.

They do it based on project timelines and priorities. It also enables better cost forecasts and budgeting. This leads to more informed decisions. By combining time tracking with project tools, accountants can simplify their workflow. They can also improve productivity. This setup fosters teamwork. It does so by giving team members visibility into each other’s tasks and progress. It promotes accountability and transparency in the firm.

It also improves communication about project status updates. Time tracking is integrated with project management tools. It empowers accountants to serve their clients well and fast.

Maximizing Productivity with Time Monitoring Features

Are you looking to boost productivity in your accounting firm? Time monitoring features can be a game-changer. By tracking time spent on projects and tasks, you can find inefficiencies. Then, you can optimize your workflow. This data-driven approach allows you to use resources better. It lets you prioritize high-value activities.

You can use this info to make smart choices to streamline processes. By knowing how long tasks take, you can set fair deadlines. This will improve project planning. This insight empowers you to maximize efficiency. You can do this across all parts of your accounting practice. Features for time tracking and employee monitoring also help identify areas for improvement.

They also show training opportunities for your team. You can find bottlenecks or repeat issues. Then, you can use targeted strategies for growth and development. Using these cloud-based time tools will boost performance. It will do so while keeping costs down. This is important in the competitive accounting landscape.

Automating Time Entry Processes for Accounting Efficiency

Automating time entry processes can greatly boost accounting efficiency. It does this by cutting manual data entry errors and saving time. It can streamline the process of logging billable hours and tasks. Automating time tracking lets professionals focus on financial analysis and client services. They can avoid tedious admin tasks. Time-saving features include automatic time, mobile app links, and customizable time reports. They make it easier for bookkeepers by providing software to keep track of time and their work in real-time.This ensures precise billing.

It also boosts productivity in the firm. Automation helps in generating detailed timesheets effortlessly for client invoicing purposes. By using a time tracker and timesheet automated time entry, accounting firms can improve their workflow. They can then provide timely and accurate financial services to clients. Automating routine tasks frees up resources. They can be used to boost business growth and profits.

Efficient Billing Practices in Accounting Firms

Efficient billing is crucial for accounting firms. It lets them keep invoices accurate and on time for clients. By using simpler processes, accountants can ensure that they bill clients correctly. They bill for the services they provided. Using advanced billing software can automate invoicing. It reduces errors and saves time. Tracking billable hours accurately is vital for clear client communication. It ensures fair pay for services rendered. Monitoring expenses efficiently allows for detailed reporting and accurate reimbursement from clients. Adding expense tracking to billing software improves financial management at the firm. This integration enables data to sync seamlessly. It gives a full view of project costs and revenue. Efficient billing helps the accounting firm. It also builds trust with clients. It does this by making financial transactions transparent.

Streamlining Client Billing with Software Solutions

Are you tired of spending hours manually managing client billing in your accounting firm? Streamlining the billing process with software solutions can be a game-changer. You can easily make accurate invoices and track client payments. You just need the right tools. You can use software for client billing.

It lets you automate repetitive tasks, like making invoices and reminders. This not only saves time but also reduces the risk of errors in your billing process. Integrating time log and expense tracking features into your billing software allows for more precise invoicing. You can easily capture all billable expenses.

They were incurred on behalf of clients, so nothing slips through the cracks. Using software to streamline client billing improves efficiency. It also improves accuracy in your accounting practice. It’s time to embrace technology to optimize your firm’s financial processes effortlessly!

Utilizing Expense Tracking Features for Accurate Invoicing

Expense tracking is a crucial aspect of accurate invoicing for accountants and bookkeepers. You can use expense tracking in billing software. It ensures that all client expenses are recorded and included in invoices. This helps prevent underbilling or missed expenses, leading to more precise financial reporting. You can categorize expenses and attach receipts in the software. This streamlines making detailed client invoices. This not only saves time but also enhances transparency in your billing practices. You track time across projects and analyze expenses with dedicated software. This gives you insights into spending. It lets you make informed decisions on cost. This approach is proactive. It helps keep profits up and build better client relationships.

These relationships are based on accurate financial data. Adding expense tracking to your accounting workflow improves invoicing accuracy. It also shows professionalism and attention to detail to your clients. Managing expenses well ensures that all billable time costs are accounted for. This helps the finances of both your firm and your clients.

Choosing the Best Time Tracking and Billing Software

The software you choose will greatly impact your accounting firm. It will impact your speed and accuracy. You must consider features. Think about integration with existing accounting software. And, the automation of time entry. This will streamline workflow and boost productivity. Using expense tracking maximizes efficiency. It ensures accurate client invoicing and saves time. Consider the key factors. These include ease of use, scalability, reporting, and support.

Consider them before deciding. In 2024, the right software can revolutionize how you manage time. It can also help you bill clients well. Choose a solution that fits your firm’s needs and goals. This will help you streamline your accounting efforts.

Key Considerations for Selecting Time and Billing Tools

When choosing time and billing capabilities tools for your accounting firm, keep key things in mind. Assess the software’s compatibility with your existing systems to ensure seamless integration. Look for user-friendly interfaces that simplify time tracking and invoicing processes. Consider the scalability of the software to accommodate your firm’s growth. Time tracking and billing tools should be able to handle more clients and projects. But, it must not sacrifice efficiency. Security is very important when dealing with sensitive financial information. So, choose tools with strong data protection. Evaluate the software’s reporting capabilities.

They can create insights on billable hours, client profits, and project timelines. Options for customizing rates and invoice templates can improve client management and communication. They can also streamline payment. Ask other accountants for feedback. Do this to gauge the tool’s reliability and customer support before deciding.

Implementing Time Tracking Software for Accountants in 2024

In 2024, it is very important for accountants to use time tracking software. Financial regulations and client demands are getting more complex. So, accounting firms need efficient tools to streamline their operations. Free time tracking software offers a solution by automating time entry. Integrating time tracking software with project management tools helps accountants. It helps them manage their tasks and deadlines. This integration allows seamless team communication. Time Doctor ensures timely completion of projects.

Using practice management software makes firms more efficient. It lets them improve their service and make clients happier. It provides accurate invoicing solutions tailored to each client’s needs. Choose time tracking and billing software that fits your firm’s needs. It will boost profit and cut admin work in 2024.

Maximizing Efficiency with Practice Management Software

In 2024, the right intuitive time tracking and billing software can greatly help accounting firms. The software also offers features like automated time entry, further enhancing efficiency and accuracy in financial management. It has features like automated time entry. These features let practitioners streamline their workflow and boost productivity.

Choosing the best time and billing solution software requires careful thought. You need to consider key factors. These include integration, expense tracking, and efficiency. Choose a solution that meets your firm’s needs. It will maximize efficiency and ensure accurate client invoicing. Using practice management software in your accounting practice improves time manually tracking. It also boosts overall business performance.

Accounting professionals can use technology to automate tasks and streamline processes. This lets them focus on giving great services. They can also manage their workload well. In 2024, accountants can use advanced time tracking and billing software. They can also use practice management tools. They also help them improve client service. Use these new solutions. They will help your accounting firm grow next year!